Key Highlights:

- Drilling thus far in 2014 at the Bruner project site has uncovered more visible gold this year than in the past which has led to a more thorough review of previous samples.

- Visible gold findings from the intercept on the Penelas vein in (RC) drill hole B-1430 prompted further metallic screen analyses which clearly indicate that particulate gold is present.

- Particulate gold was also present in a high grade intercept of drill hole B-1436, located in the open northern extension of the Penelas East Zone. Further metallic screen analysis is currently underway, with results expected in the near future

- Additional core drilling at the Bruner site is re-commencing to follow up on the high-grade intercept in RC hole B-1436 with two core holes planned thus far

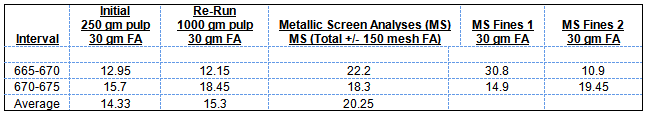

B-1430 - Summary of the different assay results for RC drill hole B-1430 interval:

In the metallic screen analysis of the high grade interval at drill hold B-1430, the +150 mesh size fraction comprised only 8% of the total gold content of the sample indicating that 92% of the gold falls in the -150 mesh which confirms that the gold is particulate (not coarse) and requires further review of sample preparation and assaying procedures to better quantify the gold content of each drill interval containing visible gold.

The above results also show that the metallic screen analysis returned an average grade for the 3 meter (10 foot) interval tested of 20.25 g/tonne, compared to the original fire assay (FA) of 14.33 g/tonne and the 1000 gm pulp re-run of 15.3 g/tonne. Two fire assays on the -150 mesh fraction of the screen assay on interval 665-670 feet returned two widely disparate values of 30.8 and 10.9 g/tonne. The 1000 gm pulp generated a 7% higher average grade than the 250 gm pulp.

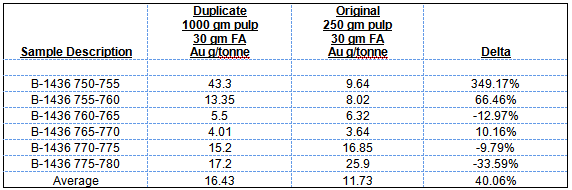

B-1436 - Results from the 1000 gm pulp re-runs from the high-grade intercept in the bottom of RC drill hole B-1436:

The 1000 gm pulp from this high grade drill interval delivered an average grade of 16.43 g/tonne, a 40% increase from the original average grade of 11.73 g/tonne on the 250 gm pulp. With clear signs of particulate gold, pulverizing a large sample before splitting out a 30 gm split for fire assay is a more representative sample. Results from the metallic screen analysis on this interval are still pending.

From the Bruner project 2012-2014 drilling program, all +3 g/tonne intercepts will be reviewed and evaluated in a similar manner with metallic screen analyses to be conducted should the fire assay data indicate potential particulate gold.

Future Core Drilling Plans

Core drilling at Bruner is re-commencing to follow up on the high grade intercept encountered in RC hole B-1436. The first core hole is designed to be parallel and adjacent to hole B-1436, reaching a depth of 1000 feet in order to test the full thickness of the mineralization within the bi-lithic breccia which hosts the gold interval from 750-780 feet (end of hole). Depending on preliminary results, a second core hole will offset the first core hole by 20-30 meters to test continuity of mineralization along strike or up dip. Further core drilling plans will be determined based on these results along with other factors.

Additional Visible Gold Characteristics

Given the visible gold present at the Bruner project site, geologists have initiated investigative work. From thin section work, there appears to be a wide range of grain sizes to electrum (native gold + silver). Primary electrum has a high silver to gold ratio, generally occurring in grain sizes of 50-250 microns. Secondary electrum has a high gold to silver ratio (native gold), generally occurring in much finer grain sizes from 5-20 microns. Both are typically found as inclusions in iron oxides after pyrite. The latter features explain the excellent cyanide extractions of gold in the samples tested on the site to date. The fine-grained nature of the low-silver bearing electrum explains the "no-see-em" aspect of the average gold intercepts in the near surface environment at the historic resource area of the Bruner project site.

The Bruner Project

The Bruner Project is situated in central Nevada, 15 miles north of the Paradise Peak mine, 45 miles northwest of Round Mountain and 25 miles east of the Rawhide mine. Historic production from the Bruner property included about 100,000 ounces at an average grade of 0.56 opt gold.

Patriot Gold's Option To Optionee/Operator

Patriot Gold owns 100% undivided rights, title and interest in the project which is subject to certain royalties and an earn-in option agreement for 70% interest. The earn-in optionee/operator, Canamex Resources Corp. (TSX-V: CSQ) (OTCQX: CNMXF), has the right to earn 70% interest in the Bruner project by spending $6 million over seven years and may earn an additional 5% by completing a bankable feasibility study for a total of 75% interest in the project. Subsequent to the optionee/operator earn-in, financing of the project will be on a proportional basis.

Disclaimer: This announcement may contain forward-looking statements which involve risks and uncertainties that include, among others, limited operating history, limited access to operating capital, factors detailed in the accuracy of geological and geophysical results including drilling and assay reports; the ability to close the acquisition of mineral exploration properties, and other factors which may cause the actual results, performance or achievements of the company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. More information is included in the company's filings with the Securities and Exchange Commission, and may be accessed through the SEC's web site at http://www.sec.gov.